Reporting & Analysis

22.02.2022

TLDR

E-commerce analytics are essential for decision-making. Key metrics include Average Order Value, Customer Lifetime Value, and Customer Acquisition Cost. Categorize products as Loss Leaders, Low-Margin Products, or Cash Cows and track Speed of Sale, Margin vs. Sales, and Product failure rates. Use platforms like Shopify, Magento, or WooCommerce for data collection and consider tools like Segment, Metrilo, Clevertap, or Airboxr for advanced analytics and automation.

As a business owner, you need everyone in the company to have a sense of data. Analytics on ecommerce data is going to determine how well your company performs. Online stores—especially those on established platforms such as Shopify, Magento, and WooCommerce—already collect a lot of data on customers.

But how do you decide how to make sense of that data?

Today, we will look at two aspects of e-commerce analytics:

What decisions you will make with the data?

More hours have been lost in collecting and cleaning data than in making real decisions that impact the business. If you are not going to make a decision on the basis of the data, then don’t bother with collecting it in the first place. In most cases, if you are using an e-commerce platform, it will collect all the data you might ever need anyway.

You will be making decisions on the following parameters throughout the lifecycle of the company:

How much should you spend on acquiring customers?

Eventually, you want to understand where your customers come from, what ads and offers work best to entice them, what pages do they visit, how long do they browse before they make a purchase, and how much do they spend. Each of those decisions is a 1,000 word article on its own: so we will focus first on identifying your most valuable customers and then determining how much you should spend on acquiring them.

This will require you to look at the following metrics:

Average Order Value—This simply refers to the average amount of money customers spend on each order (which may, in turn, contain multiple items). This is driven by customer purchasing behavior and informs the kind of products you should stock in your store.

Average Order Value = Total Sales / Number of Orders

Customer Lifetime Value—This refers to the total amount of money a customer is expected to spend before churning (i.e., before they stop purchasing from you for good). The aim is to maximize this amount and keep the customer around for as long as possible. This determines how much you can afford to spend on acquiring a customer.

Customer Lifetime Value (LTV) = Average Order Value * Purchase Frequency * Average Customer Lifespan

Customer Acquisition Cost—This refers to the amount of money you have to spend to make a customer make their first purchase. If you spend money on getting the customer back to make repeat purchases, you should add that cost to the metric too.

Customer Acquisition Cost = Total Cost spent on Sales and Marketing / No. of New Customers Acquired

The three metrics are highly correlated. When you begin spending dollars on acquiring new customers, you will want them to start spending money on your store. The more they spend, the more their Customer Lifetime Value will be. The more their Customer Lifetime Value is, the more you can spend to acquire them.

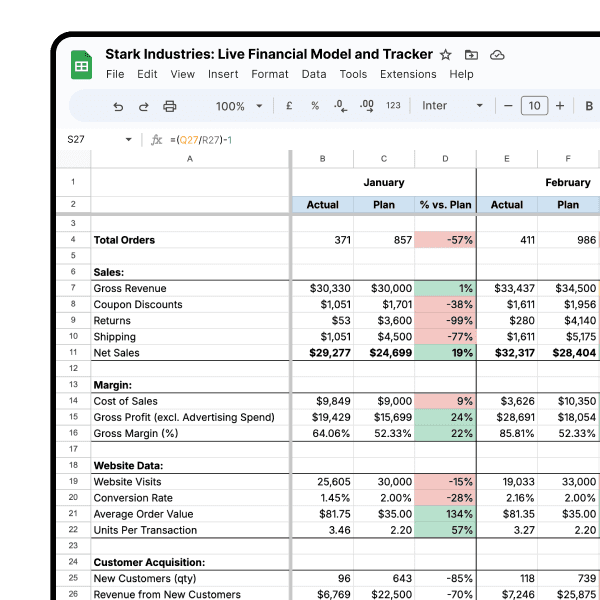

The ratio of LTV (or CLV, as it is sometimes called) to CAC is very important. The folks at Geckoboard explain this in the graphic below.

But what ratio should you aim for? How much should you spend?

If your ratio of LTV:CAC is 1, you don’t have a business (yet). If you are just getting started with your store, you can spend a few more months of getting this right. Typically, for a scaling company, aim for a ratio between 3x and 5x. If you are not making 3x the money from a customer over their lifetime, you need to focus on finding the right customer. If you are making more than 5x the money, then you are (counterintuitively) leaving money on the table... you should increase your marketing budget to get more customers!

If you are making more than 5x the money you spend on acquiring each customer, then you are (counterintuitively) leaving money on the table... you should increase your marketing budget to get more customers!

If you have started your store in the past year, you probably don’t know how long a customer is going to stick with you. So how do you determine the lifetime value of a customer if you don’t know what the lifetime is?

Before I answer that question, let’s take a step back and talk about three key elements of Customer Lifetime Value—recency, frequency, and monetary value. Known as RFM analysis, it helps us prioritize customers in terms of their value to the business.

Recency—this simply refers to the last time the customer made a purchase. If the last order was recent, the customer can probably be convinced to make another purchase soon. If a customer hasn’t been to the website in a year, it is unlikely you will be able to get her back to the website.

Frequency—this refers to the number of times a customer has made a purchase within a given timeframe. E.g., a customer that makes three purchases a month is likely more valuable than a customer who makes three purchases in a year.

Monetary Value—this refers to the amount of money that a customer has spent on your store within the same timeframe. A high spender is more likely to continue to spend more over the coming months since she has already trusted you with her business over the past.

To learn more about conducting an RFM analysis, refer to our detailed instructions on using RFM analysis to identify your most valuable customers.

Coming back to the lifetime value, first calculate the Purchase Frequency using the following formula.

Purchase Frequency = Total Orders / Total Customers

If you are a new store, you should be fine with taking 3 years as the lifetime period of your customer. Now, take Purchase Frequency from the formula above, assume lifetime as 3 years, and plug in the numbers into the formula below to find your LTV.

Customer Lifetime Value (LTV) = Average Order Value * Purchase Frequency * Average Customer Lifespan

That’s it, you now have your Customer Lifetime Value. Now all you have to do is tweak your acquisition cost to ensure that your LTV is between 3x and 5x your acquisition cost.

💡 Measure customer metrics by cohorts. In addition to measuring the above metrics, you should also split the metrics by different dimensions. For instance: measure LTV and Purchase Frequency by customer acquisition channel. This will help you identify if users from search advertising are more valuable than those coming through social media.

What products should you stock?

Some stores are single-product stores, others with a small curated selection, while others still will sell hundreds of thousands of products on their store. If you have more than 20 products on your store, it might be difficult to keep track of the products that truly make your store shine.

I am going to use an incredibly simplified way to look at your product portfolio—the three types of products you could stock at scale:

Loss Leaders—These are the products that you could sell at lower-than-usual margins (try not to sell below cost, as far as possible) but those that entice users to come back for more purchases or add more products in their cart during the same transaction. Two very popular examples of loss leaders are razors and printers, Gillette will sell you a razor very cheap only to gouge you on the blades! If you don’t want to do that to your customers, you could sell a classy evening wear at $50 and upsell other product that “pair well with it” at a high margin.

Low-Margin Products that are Profitable—These are typically undifferentiated products sold as a “fair price”. E.g., generic bluetooth earphones, petrol at the fuel station, etc. What they lack in margins, they make up in a regular cadence of sales. If you manage your customer acquisition well, you could run your entire store with such products too.

Cash Cows—These are the products that command a high margin while keeping customers satisfied. These are the iPhones, the niche jewelry, and the niche fan merch. According to PriceMole, the average jewelry margin is 100%, making it one of the most profitable product lines to sell online.

You must know which products fall into which category. And price (and stock accordingly).

You should never run out of your loss-leaders and low-margin products. You could—if your category allows—create scarcity in your cash cow products to maintain exclusivity and command the high price.

So what metrics should you look at?

It is easy to get lost in the metrics. To start off with, these three matter the most:

Speed of Sale/Days of Inventory—This is a measure/proxy to identify the products that sell the fastest. These products might be loss-leaders or low-margin products (nothing wrong with that) but knowing when you will run out of those products will help you restock them on time.

Many companies tend to simply track days of inventory for all their goods; don’t bother with that because it won’t help you arrive at any actionable decision for your business. Instead, look at the rate of sale of each of your SKU’s. E.g., if you typically sell 10 pieces of a JBL speaker every day and you have 150 pieces in stock, then you have 15 days of stock on hand. If your lead-time to get more stock in from your supplier is 10 days, then you need to reorder another back of JBL speakers 5 days from now.

This is important to track at the SKU level to prevent stock-outs. You can’t sell what you don’t have (in most cases) and you could be losing sales if your popular inventory remains out of stock.

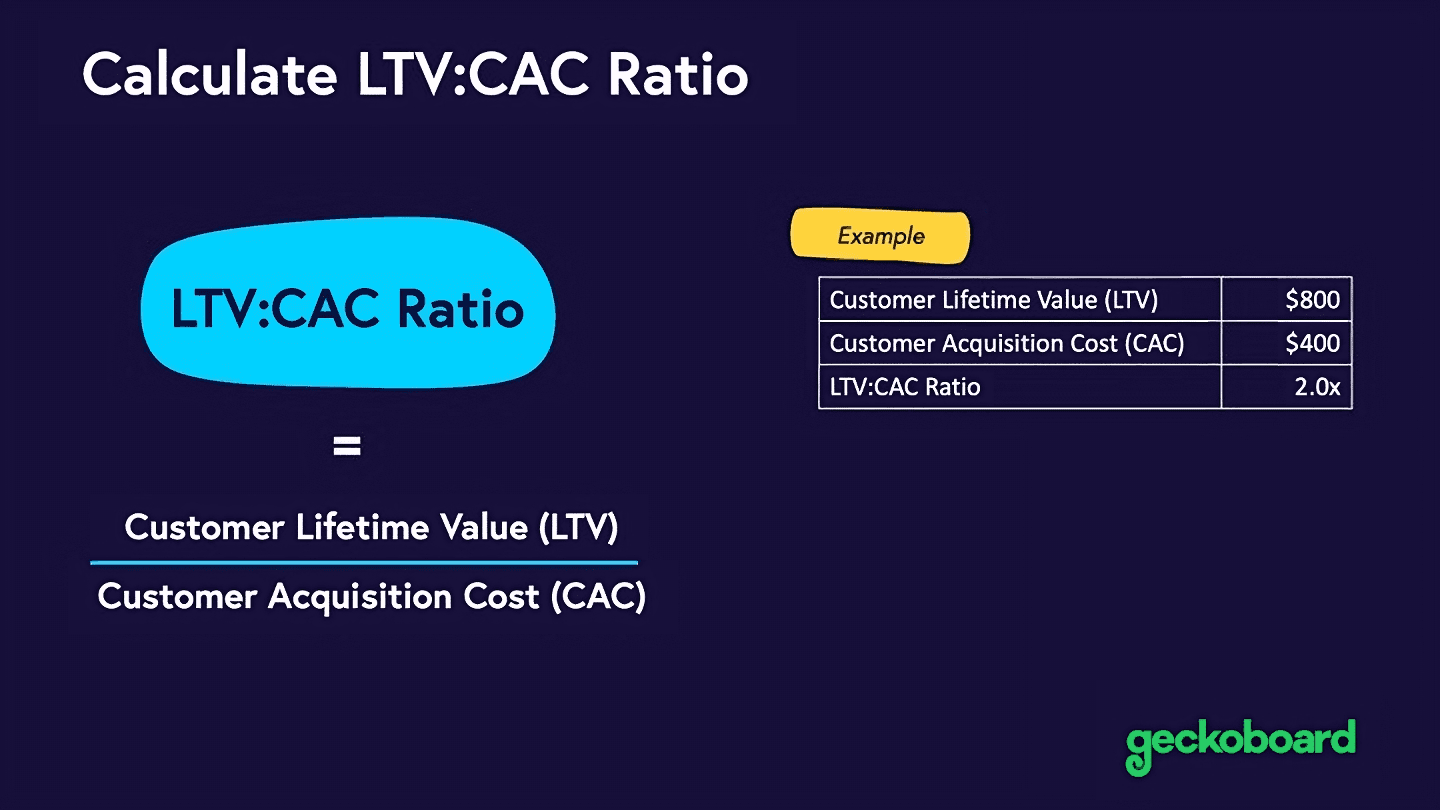

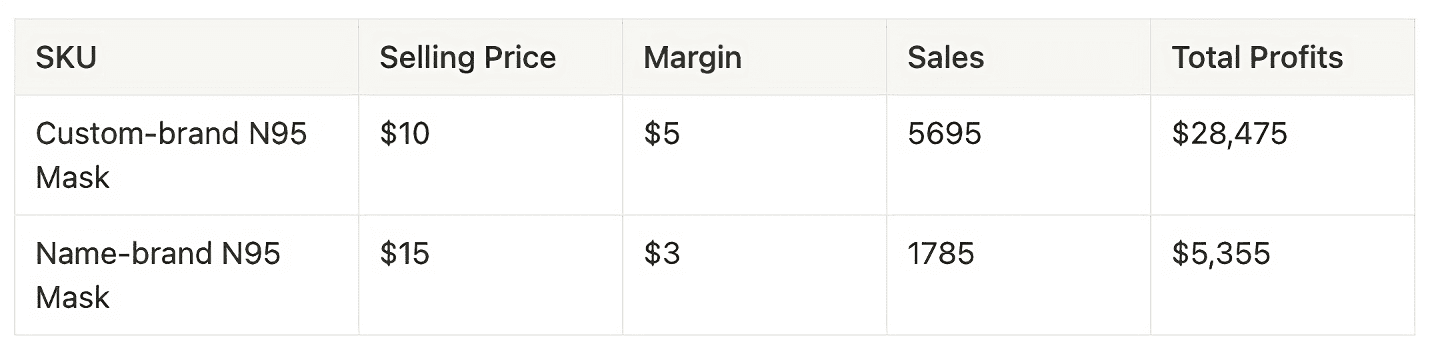

Margin vs. Sales by SKU—Not a very obvious one for early stores, but it is essential to track how your margins vs. sales look like for each SKU (stock keeping unit). If a specific SKU is selling a lot and margin is razor-thin, you could potentially speak to the supplier for better prices or raise your own prices a bit to see if sales drop. If a fast-moving SKU operates on razor-thin margins, you might actually be losing money after delivery issues and returns.

Remember to remove your returns to calculate both margins and sales accurately. You are losing the money you spent on shipping to- and from- the customer. Some portion of the returns will also not be ready for resale. You will need to account for them as you decide which SKU’s to stock.

Product failure rates—If certain products have high returns, replacements, or refunds, it is likely that there is something off with those products. If they are being returned right after delivery, maybe they are prone to damage during shipments? If they are being returned after use, maybe customers run into manufacturing defects? It is therefore essential to track these three metrics (both in number of items as well as their $$ value) on an ongoing basis.

Bonus: Cross-sales, especially for loss leader—Loss leaders are tolerated in a business because they eventually lead to sales of other high-margin products. But the same loss leader product may not continue to drive sales of other SKU’s forever. You need to track whether a loss leader product is managing to drive other sales by analyzing the ordered items inside each order. Separate out the orders that contain your loss leaders, then analyze what other products those orders contain. Maybe even recommend those products on your website whenever a customer adds the loss leader to cart.

Loss Leader Pricing Strategy. A loss leader is a product that is sold below cost (or, at least, at a lower margin that other products) to set up a second sale of a high-margin product. The “cart” or total order profit compensates for the loss from the loss leader product.

Download our Growth Works whitepaper for a list of 22 metrics and global benchmarks for your online store.

Improve your DTC game. Sign up for weekly tips.

How do you ensure you’re collecting the right data?

If you’re launching a new store, you should stay away from creating your online store from scratch. Use a popular e-commerce platform to build and launch your store quickly. The top platforms to help you launch your e-commerce store quickly are:

I will not get into comparing the above in detail, that is a whole other article: but as a rule of thumb if you have a low number of SKU’s and are just getting started, Shopify is the way to go. Shopify has great themes for your store and a wide selection of store apps to add functionality. If you are seeking the best talent for your e-commerce business, Toptal is a marketplace for top Shopify developers, engineers, programmers, coders, architects, and consultants. You can also put up a job posting if you have any vacancies for remote Shopify developers.

Each of these platforms have their own data collection schema, so you wouldn’t need to bother with collecting data-points on your customers all by yourself. The platforms will provide you with all of the raw data you need to calculate the metrics above.

If you want to take it a step further, you would also consider the following:

Segment—Segment captures events (or actions) that your customers take on your website and sends it to different data destinations. E.g., if a user views a specific product, but doesn’t add it to cart, Segment can send that information to an analytics dashboard.

Metrilo—Metrilo connects to your online store and provides visual dashboards to help you import or visualize customer data coming from Shopify. It has pre-built event tracking, so there is minimal set-up for you.

Clevertap—Clevertap tracks actions on your website and also sends triggered email or popups based on the action that users take on your site.

Airboxr is a revenue analytics platform that automates your data collection and analysis, all within the familiar interface of Google Sheets. You can connect to Shopify, your ad channels, and email platforms and automate all your data analysis and reports to run on a fixed schedule. If you are a Shopify store, see our platform in action in our interactive demo.