Reporting & Analysis

Dec 7, 2023

TLDR

Founders and revenue leaders must understand how profitable their business is, and what levers they can use to improve profitability. Standard marketing metrics don't account for profitability—it is important to understand gross margins and contribution margins to truly understand the health of your business.

For aspiring entrepreneurs and marketers in the e-commerce industry—particularly in fashion, consumer packaged goods (CPG), and beauty—understanding profit metrics is crucial. It forces founders and revenue leaders to understand their sales as well as the cost of servicing those sales. Let's look at the core profitability metrics you should track for your business.

Profitability metrics allow you to assess not only your sales figures but also your ability to manage costs and generate profits. For instance, while gross profit margin sheds light on the costs directly associated with your products, net profit margin encompasses all business expenses including operating expenses and fixed expenses, providing a comprehensive financial overview on business profitability.

The challenge lies in determining which metrics are most relevant to your specific business and industry, especially for those new to e-commerce. Whether you are in the fashion, beauty, or consumer packaged goods (CPG) sector, familiarizing yourself with metrics such as gross profit margin is essential. These metrics provide a clear picture of your earnings and expenses, enabling you to the financial health of your business, assess your profitability, and identify areas for improvement.

Which profitability metric should you track?

For new e-commerce entrepreneurs, especially in fashion, beauty, and CPG, it's important to know these profit metrics:

Gross Profit Margin: This metric measures how much profit you generate from product sales after paying for the costs of making them (typically called Cost of Goods Sold). For example, if you sell a dress for $100 and it costs $60 to make, your gross profit margin is 40%.

There can be fluctuations in gross profit margin even though there is an increase in sales your company generates. One possible reason could be changes in the cost of goods sold (COGS). Changes can either be in the form of a decrease in COGS due to a temporary reduction in raw material prices or better deals with suppliers. It can also be in the form of an increase in COGS due to a shortage of raw materials or an unexpected rise in production costs such as labor expenses or energy prices. Businesses should always try to maintain stable gross profit margins across quarters. This means determining optimal pricing and reviewing production costs.

Contribution Margin (CM1, CM2, CM3): These give a detailed look at profitability. They are expressed as a percentage of total sales.

CM1: Sales value minus the cost of making the product (COGS). This is commonly also called Gross Margin. This is useful for determining if your products are adequately priced given their cost of production.

CM2: CM1 minus the directly attributable variable costs of sales e.g. logistics, warehousing, and payment gateway fees. This is used to determine if you are charging enough in fulfillment/shipping or if there is a need to explore cheaper alternatives in warehousing, shipping, payment platforms, etc.

CM3: CM2 minus offline and online marketing costs (but not marketing salaries). This is used to determine if your marketing efforts are converting enough customers.

Net Profit Margin: This shows how much of your total income is actual profit, after all expenses. This includes costs like salaries, rent, and other fixed costs. So, if your store earns $100,000 and your total costs are $80,000, your net profit margin is 20%. Monitoring the net profit margin over time allows businesses to assess their financial performance and make informed decisions. A consistent or increasing net profit margin indicates that the company is growing and becoming more profitable.

Understanding these financial metrics also helps you see how well your store is doing financially, measures profitability, and guides your business decisions. Note that the terms used around the world might differ, so make sure you clarify which profit margin is being referred to. For instance, Shopify doesn’t differentiate between Contribution Margins 1, 2, and 3 in this article.

What benchmarks should you aim for?

According to Shopify, the average net profit margin for online brands is around 10%. However, high net profit margins can reach up to 20%, while low margins may fall around 5%. It is important to note that these figures can vary depending on your costs and sales. For example, if your company is currently focused on revenue growth, it may be wise to slightly reduce margins in order to prioritize generating more revenue. Additionally, industries such as fashion and beauty often have higher margins, provided that inventory management is effectively handled. On the other hand, consumer packaged goods (CPG) companies may need to invest in distribution, partnerships, and inventory, which can lead to reduced variable expenses and lower net margins in the early stages.

To determine the appropriate benchmark to measure profitability of your business, it is recommended to track your current margins and strive to improve them every quarter. By monitoring your current margins and making efforts to enhance them regularly, you can gain valuable insights into the financial health of your business. This practice allows you to compare your performance against industry standards and identify areas where you can make adjustments to optimize your business's profitability. Additionally, tracking your margins every quarter enables you to assess the effectiveness of any implemented strategies or changes in your business operations. By aiming to improve your margins consistently, you can ensure the long-term success and sustainability of your business.

Improve your DTC game. Sign up for weekly tips.

How can you track these metrics?

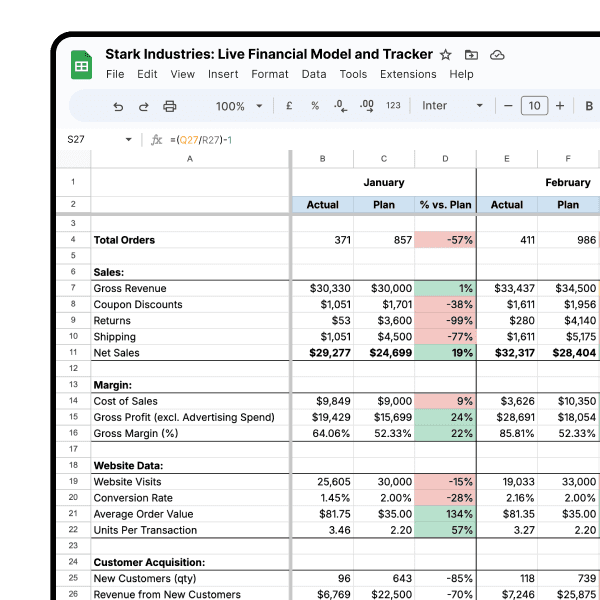

As a business, the best place to keep financial statements and track profitability is on your accounting software—like Xero or Quickbooks. However, accounting software rarely gets updated in real-time, so it doesn’t help you make decisions in real-time.

Shopify (and other e-commerce platforms) typically have information on your sales and cost of goods sold. They provide a better source of truth to pull your Gross Profits/CM1 from as long as you keep your product costs properly updated on the platform. Combining this data with your ad spend data from Meta, Google, and TikTok allows you to measure how much profitable returns your ads are generating ie Profit on Ad Spend (POAS).

If you are an Airboxr user, you can use the Profit on Ad Spend over Time report to find your CM1 on a daily basis. You can then view trends in daily profits and compare those trends to your ad spend. Viewed over a quarter or more, this will also help you determine the right budgets to allocate to balance sales and profits.

How can you improve your performance on these metrics?

There is no right way to improve profitability that applies to all companies. That said, there are some levers you can use to determine what works best for you:

Optimize pricing strategies using dynamic pricing based on supply, demand, and competitor analysis. This allows you to charge higher during high demand to improve the revenues on the same COGS.

Improve website user experience for higher conversion rates, focusing on mobile optimization, easy navigation, and fast loading times. This allows you to get more sales for the same traffic (or ad spend).

Employ efficient inventory management, utilizing data analytics for accurate demand forecasting and reducing holding costs. This helps you manage cash flow better by ensuring your cash is not locked up in slow-moving inventory.

Refine marketing strategies with targeted and personalized approaches to increase customer acquisition and retention. Focus on the core channels and messages that work profitably—measure the profitability of each of your campaigns as I showed in the video above.

Expand into new markets and diversify product offerings to explore new revenue opportunities. Often, expanding into higher AOV markets or offerings will allow you to improve your profitability. However, this approach might have higher fixed costs leading to lower CM3.

There is no single way to improve your profitability but, using the levers above, you can track and improve your profits over time.